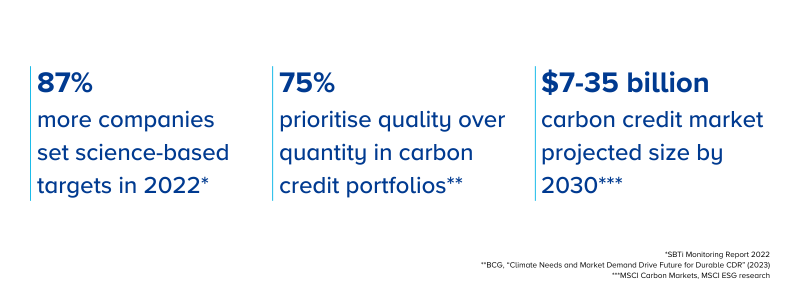

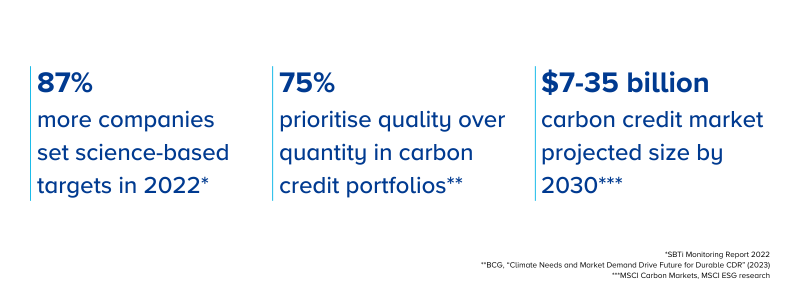

In today’s fight against climate change, companies must go beyond reducing their carbon footprint – they must take immediate action. One effective way to do this is by investing in a well-structured carbon credit portfolio. This article explores the key steps and benefits of building a high-quality carbon credit portfolio, ensuring that businesses contribute effectively to global climate action. Why carbon credits matterThe Paris Agreement set legally binding emissions reduction targets, yet global emissions continue to rise. The Science Based Targets Initiative (SBTi) provides companies with a roadmap to reach net zero through science-based targets. However, reducing emissions alone is not enough; businesses must also invest in certified climate projects to address unavoidable emissions. Carbon credits represent the reduction, avoidance, or removal of one tonne of carbon dioxide or its equivalent through climate projects. Supporting such projects enables companies to take responsibility for their emissions while also contributing to broader environmental and social benefits.

Free guide: Building a Carbon Credit PortfolioA step-by-step framework for building a high-quality carbon credit portfolio. Learn how to select project technologies, develop a pricing and procurement strategy, identify credible suppliers, and make informed purchasing decisions.

Benefits of a diversified carbon credit portfolioA well-rounded carbon credit portfolio not only helps companies meet ESG goals but also provides additional advantages: - Immediate climate action: Companies can take steps beyond internal emissions reductions, ensuring that they contribute to the climate today rather than waiting for long-term changes.

- Achievement of sustainability goals: By purchasing carbon credits, businesses can align with corporate sustainability targets and long-term environmental commitments.

- Cost management: Strategic carbon credit investments allow organisations to optimise financial resources, reducing the risk of unexpected costs and ensuring long-term financial efficiency.

- Supply security: With a diversified portfolio, companies safeguard access to high-quality carbon credits in an evolving and sometimes volatile market, avoiding potential shortages.

- Significant co-benefits: Carbon credit projects support social impact initiatives, improve the quality of life for underserved communities, and drive local economic development by creating employment opportunities.

- Strengthened corporate reputation: Companies that actively invest in climate projects showcase leadership, reinforcing their brand image and building a strong market presence.

- Enhanced stakeholder trust: Transparency and meaningful contributions to climate action help build confidence among investors, customers, and employees, ensuring continued support for the company’s sustainability initiatives.

Building a high-quality carbon credit portfolioA carbon credit portfolio should align with a company’s broader sustainability strategy, complementing efforts in renewable energy, energy efficiency, and sustainable supply chains. Climate projects are categorised by technology, including nature-based solutions, renewable energy, energy efficiency, and technological solutions, which can compliment a company's strategies and interests. Strategic procurement is essential for managing costs and maintaining flexibility. Companies should assess their carbon credit needs based on annual volume requirements and budget constraints, balancing immediate purchases with forward contracts for future issuance. To maintain credibility, companies should communicate their climate contributions transparently. Using factual, verifiable data and avoiding misleading claims strengthens trust. Instead of vague terms like "carbon neutral", businesses should emphasise "climate contribution" and highlight the broader social, economic, and environmental impacts of their initiatives. Investing in a high-quality carbon credit portfolio enables companies to take meaningful climate action today. By following the approach outlined in our step-by-step guide, businesses can maximise impact, ensure compliance with evolving regulations, and build trust with stakeholders. Want to start your journey toward climate responsibility? Find out more |